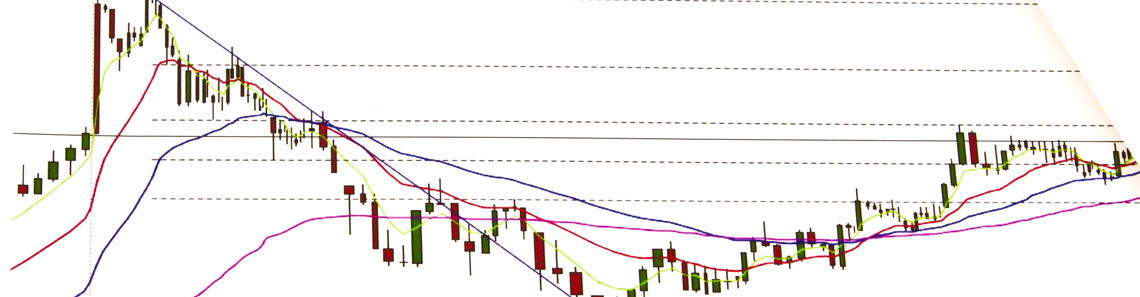

Is the equity selloff over?

US equity sell off increased during the previous week with it registering a steep 10% fall spanning 2 weeks. The selloff was triggered by anxieties over greater control by central banks globally that would put a stop to the accessibility of easy money.

Gold sold off last week as it could not break the $1351/oz. hurdle which was a setback for the bulls and a consequent sell off witnessed the yellow metal reaching $1309/OZ following which bargain seekers stirred Gold back up to end the week at $1317/oz.

GBPUSD reached a high of 1.4068 on Thursday after BoE elevated growth forecasts and odds of quicker than anticipated rate increases. But hopes were dashed soon after with Friday’s dismal economic data. GBPUSD went on to shed all the profits and end at 1.3824.

USDJPY was feeble owing to extra volatility in equity markets worldwide and ongoing JPY strength was compelling exporters to move into hedge their JPY exposure. USDJPY closed the week at 108.75.

USDCAD traded firmly during the previous week, Friday’s poor jobs statistics from Canada augmented the increase to 1.2675 ahead of the fine print depicting a not so dire picture. Majority of the jobs gone were stop-gap ones while the economy had rather added more permanent jobs than projected, which boosted CAD bulls to propel USDCAD back below 1.2600 to finish at 1.2575.

The following week must begin on a sluggish note as Japan and US would be shut on Monday for national holidays.

Gold bulls would like Gold to reach $1351/oz., else jeopardize another round of profit booking that should witness gold testing support at $1300/oz. Despite that the upturn will still remain untouched if $1285/oz. isn’t broken. US equities garnered 500 pts from the day’s slump on Friday which implies a bounce back, which would see Gold edging lower.

EURUSD is likely to test support at 1.2100 if the equity breakdown persists.

GBPUSD is wedged between the good tidings & bad tidings and more are likely on Tuesday when the inflation reports are published. The bears seem decisively in control after 1.40 was rejected once more the previous week. GBPUSD looks set to test support at 1.36.

USDJPY seems feeble on the charts with support at 108.50 and resistance from a tumbling trend line at 109.40. 108.50 was tested and rejected on several occasions during the week gone by but falling tops imply the bottom should yield quickly enough.

USDCAD ended the past week at 1.2575 near the resistance at 1.2660, and a favorable domestic economic climate excepting the NAFTA peril would imply that USDCAD is likely to test its initial support at 1.2500.