Market Outlook, March 19, 2018 - Trump wasn’t willing to give up his trade war talk one bit as he specified trade surplus with Canada.

President Trump raised the threat of trade war once more this time alarming China and India with reciprocative taxes a week later imposing the same on steel imports.

Last week Fed’s Powell in his maiden testifying session send markets into a spin as he rather astonishingly sounded rather hawkish raising hopes of quite the presently expected 3 rate hikes next year.

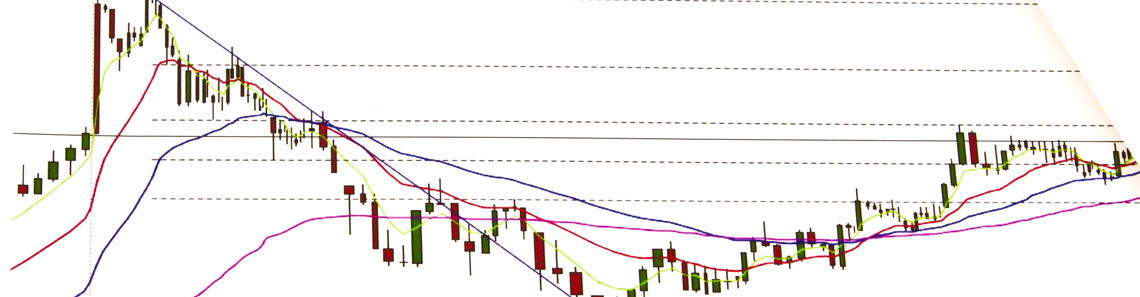

FOMC minutes released on Wednesday showed optimism about the US economy as minutes were interpreted to be hawkish. Gold that had another go at $1351 failing once more to close down at $1328 once finding support at $1319, wherever the rising trend line sits.

Gold attempted yet another go at the resistance at $1351/oz., momentarily breaching it but was unable to advance any further ending down at $1349/oz. US statistics from the previous week backed gold as stagflation fears made a comeback with US inflation perceived to be greater, while retail sales were lesser.

US equity sell off increased during the previous week with it registering a steep 10% fall spanning 2 weeks. The selloff was triggered by anxieties over greater control by central banks globally that would put a stop to the accessibility of easy money.

The past week got over with the USD increasing on Friday after the US jobs figures signalled that employment and income growth were positive in January, paving the way for swifter rate increase by the Fed this year.

Last week closed with the USD falling against other major currencies on Friday, its greatest drop since June owing to the comments by U.S. Treasury Secretary Steven Mnuchin endorsing a frailer dollar.

The week drew to a close with a closedown affecting US government as the senators were unable to reach any consensus on the budget for the wall.

Dollar has begun 2018 on a rather dismal note. Anticipated rate increases have been put off and a slovenly inflation stance won't make the Fed raise rates anytime soon.